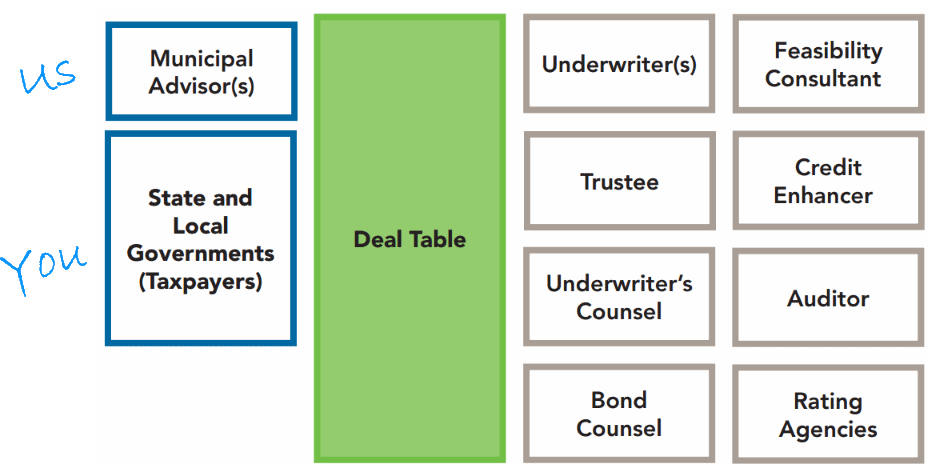

As an independent advisor, Ranson Financial Group LLC has no relationship with any underwriting firm. In the bond sale process, we work for only one side of the transaction – for you, the issuer of municipal bonds.

Unlike independent advisors, many underwriters work on both sides of the transaction and attempt to serve both the issuers and purchasers of bonds. The underwriter’s conflicting goals are to obtain the lowest rates for issuers and reap the highest rates for the purchasers of those bonds.

Project Planning and Bond Issuance

General Obligation Bonds and Temporary Notes, Utility Revenue Bonds, Industrial Revenue Bond Financing

Special Assessments and Improvement Districts

Economic Development Financing

Refunding of Existing Debt

Leases and COPs (Certificates of Participation)

Continuing Disclosure Services

Insured, Rated and Non-Rated Issues

Negotiated and Competitively Marketed Financings

Debt Analysis

Capital Improvement Planning

Debt Financing for Cities, Counties, Hospitals, Schools, Utility Districts and Other Municipalities

We believe advising our clients carries with it an important trust. Our 175+ years of experience is built upon putting our clients first. We incorporate our financial advisory professionals’ market expertise with our understanding of Kansas municipal finance and the collaborative power of teamwork to advise on each client’s unique objectives. Our goal is to reduce our clients’ financing costs and identify risks in ever-changing markets.