Kansas Municipal News

Wichita considers property tax relief for some lower-income residents

The city of Wichita wants to establish its own Homestead Property Tax Relief Program if a 1% sales tax proposal is approved by voters on March 3. The state already has such a program, which provides low-income residents with up to hundreds of dollars in property tax rebates each year.

Read more: Wichita Eagle

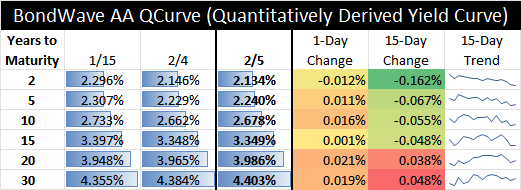

Municipal Bond Trends for February 5, 2026

The interest rate table above illustrates recent changes in a sample of AA rated bond trades reported to the Municipal Securities Rulemaking Board’s EMMA® system. Every issuer’s credit is different, and other financing sources may be available. To obtain comprehensive Financial Advisory services for your local government, contact your Ranson Financial Municipal Advisor, Larry Kleeman, or Henry Schmidt.

CoreCivic receives Leavenworth planning commission approval in contentious meeting

CoreCivic is a step closer to reopening its private prison in Leavenworth as a lucrative immigration detention center after the city planning commission approved a special use permit over objections from local advocates. A four-hour planning commission meeting on Monday included input from advocates on both sides of the issue, ejection of a long-time community teacher after he yelled about free speech and police escorts for CoreCivic officials when they went to the restroom. Approval, with one no vote from board chairman Ken Bateman, came after the planning commission made changes in the permit originally recommended by city staff, including questioning CoreCivic officials in attendance about their processes. The permit will now move to the Leavenworth City Commission for a vote.

Read more: The Lawrence Times

De Soto Panasonic battery plant nearing 50% production, second wing underway

Panasonic’s Kansas battery plant will ramp up to 50% of its production capacity in the next few months, a company executive said Monday. Kristen Walters, Panasonic Energy vice president of human resources, said the company is starting two new production lines at its De Soto plant, adding to two lines already in operation. Construction has begun on the second wing of the lithium-ion battery cell plant, and two of the wing’s four lines will be in operation in 2027, Walters said in a virtual interview. The plant opened in July amidst concerns political changes would affect operations. The Trump administration eliminated tax credits for buying electric vehicles, which dropped the industry’s sales at the end of last year in the fourth quarter by 36%, year over year, according to Cox Automotive. Walters said Panasonic Energy has added battery customers in addition to Tesla, which is its largest customer.

Read more: The Lawrence Times

City may end publishing legal notices through The Mercury

Manhattan city officials are discussing ceasing the publication of legal notices in The Mercury and instead posting them on the city government’s own website, driving through a loophole in state law. City manager Danielle Dulin proposed the switch during the city commission’s retreat Tuesday, saying that it would save $17,000 to $20,000 per year and streamline workflow. Under Kansas law, cities are required to designate an official newspaper for publishing legal notices, which also go to the newspapers’ websites and a searchable database of similar notices from around the state and nation. A legal notice is an advertisement to notify the public about impending government actions, like a tax increase or a rezoning of property.

Read more: News Radio KMAN

City of Hutchinson Launches “Build Hutch” to Empower Local Small-Scale Developers

The City of Hutchinson is launching Build Hutch, a new small-scale developer program designed to help local residents turn interest in development into action and reinvest directly in Hutchinson neighborhoods. Build Hutch represents a new approach to local development. Rather than relying solely on outside developers, the City is intentionally building capacity among residents who already live, work, and invest in the community. The program focuses on small, achievable projects that collectively strengthen neighborhoods and support long-term growth. The program is led by the City of Hutchinson’s Strategic Growth Department, with funding awarded by the Hutchinson Community Foundation and program delivery provided by Neighborhood Evolution, a national leader in small-scale development training.

Read more: Ad Astra Radio | Your Hometown Radio Stations & Local News Source

McPherson County Commissioners to Extend Moratoriums, Approve Zoning Code Amendment on Race Tracks

McPherson County Commissioners Monday approved the final resolutions to extend moratoriums on battery and hydrogen energy storage systems to Sept. 1 and another for data centers to Dec. 1. All three resolutions have a provision where they can be lifted individually as such time as regulations are in place. Also approved was a zoning code amendment related to race tracks that sets out requirements for special use permits, including that they be at least one mile from existing homes, schools, hospitals or platted subdivisions. It also includes a notification requirement for property owners within a five-mile radius and sets out other regulatory criteria. Even with the enlarged radius, the area from which protest petitions can be filed remains as is. Purchase of new service weapons for McPherson County Sheriff’s Office Reserve Officers was approved. Sheriff Jerry Montagne said in the past reserve deputies had to furnish their own weapon, but that changed largely for liability reasons, including a desire to have all officers, regular or reserve, to have the same weapon.

Read more: Ad Astra Radio | Your Hometown Radio Stations & Local News Source

County seeks ways to slow down power line

Cowley County will consider actions it can take to try and slow down the construction of a proposed Evergy electric transmission line through the county, commissioners discussed during their Tuesday meeting. The project has been met with widespread opposition from property owners, who say it will damage the land and infringe on private property rights, among other concerns. The Cowley County Commission has also formally opposed the project. The transmission line, called the Buffalo Flats project after the name of the substation near Garden Plain where the line would begin, would cross through Sedgwick, Sumner, Cowley and Chautauqua counties, ending at the Kansas/Oklahoma border, with the remaining 30 miles built by another company before ending at an electric substation in Delaware, Okla. Evergy has said the project will enhance electrical reliability and strengthen the power grid.

Read more: www.ctnewsonline.com

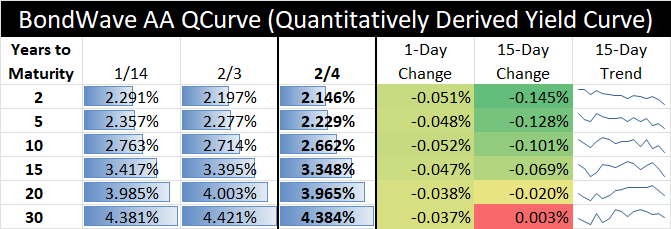

Municipal Bond Trends for February 4, 2026

The interest rate table above illustrates recent changes in a sample of AA rated bond trades reported to the Municipal Securities Rulemaking Board’s EMMA® system. Every issuer’s credit is different, and other financing sources may be available. To obtain comprehensive Financial Advisory services for your local government, contact your Ranson Financial Municipal Advisor, Larry Kleeman, or Henry Schmidt.

County, City approve task order for Bypass study

The Finney County Commission approved a task order for a US Highway 83/50 Bypass study at its regular meeting on Monday. Derek Ramos, Finney County Administrator, said Finney County Commission and the Garden City Commission directed staff to develop a task order via Wilson and Company in order to provide technical assistance to both governing bodies on the US Highway 83/50 Bypass study the Kansas Department of Transportation is conducting. A Request for Proposals for professional services related to the study is due to KDOT by Feb. 4, Ramos said. “KDOT anticipates executing an agreement with the selected consultant by the end of March 2026, with the study scheduled to begin April 1, 2026, and take approximately one year to complete,” he said. Ramos said the task order will have Wilson and Company serve in a technical advisory position specific to the Bypass study, providing technical representation for the governing bodies throughout the study’s process, assisting staff and elected officials in communicating and advocating for local interests.

Read more: Garden City Telegram

Food & Farm Council helps people fill their stomachs

The Harvey County Food & Farm Council is celebrating a decade of finding ways to get food to people. They’ve done that in many ways, and they’re working on more. One of the council members, Peace Connections Director Kendra Davila, said she feels they’re building a more resilient food system. An example of that is the Double Up Food Bucks, which is a statewide food program. People can use the food bucks at the local farmer’s market if they qualify and then can purchase $20 worth of food there for $10. The council is an advisory group of the Board of Harvey County Commissioners, said Harvey County Health Department Director and Council Coordinator Lynnette Redington. The council has 16 members and two vacant spots. They don’t lobby. They just educate and advocate, if need be. They advise the commission on food and tell them about the council’s stance on topics.

Read more: Harvey County Now

Here we go again: Halstead council discusses another ban

The Halstead City Council referred another new technology to its planning and zoning committee for consideration and reporting back. Instead of a battery energy storage system (BESS), this time it’s data centers and cryptocurrency mining facilities. Following Harvey County’s moratorium on data centers, Halstead Mayor Gary Faelber asked the Halstead City Council to consider a moratorium on commercial data centers, as well. Council Member Charlie Robinson said he was opposed to a ban without P&Z having a chance to look at it and weigh in. Faelber said the facilities are a nuisance. “In my opinion, the people have already voted on such a subject, and it was a resounding, ‘We do not want this kind of stuff in our city,’” Faelber said. City Attorney Brad Jantz told the council they could instill a moratorium with little notice, and they could rescind it at any time, even if they put a specific time period on it. On Jan. 13, Harvey County Commissioners agreed on a moratorium on data centers in the unincorporated areas of Harvey County until Jan. 1, 2029.

Read more: Harvey County Now

“Across the board” departmental savings keep City operating in the black

With inflation at 3% and Hays City sales tax collection only up 1% in 2025, Finance Director Kim Rupp told City Commissioners that savings “across the board” helped keep the City operating in the black. “You can’t pinpoint any one particular thing. A couple of departments, Fire in particular, operated almost the whole year under-staffed so they saved some salaries,” said Director Rupp during the January 22nd City Commission Meeting. He added that a number of departments also did not use their contingency funds. “They kept expenses down, even with their regular general supplies and materials across the boards throughout all the budgets,” Director Rupp said.

Read more: Hays Daily News

Kansas lawmakers weigh where authority lies in 11-year water dispute

Lawmakers are attempting to resolve a water dispute between two Kansas cities and a neighboring county that has spawned three lawsuits, one administrative case and, most recently, a piece of proposed legislation that could modify county authority. The outcomes could determine what roles state officials and local governments will play in securing quality water supplies for future generations. One lawsuit has been dismissed, another is making its way through the court system, and the administrative case before the state’s Water Transfer Panel is in a holding pattern. But a bill that advanced out of a House committee Tuesday would amend state law to forbid county authorities from regulating water appropriation in ways that may conflict with state authorities.

Read more: Kansas Reflector

A new strategy in Kansas builds whole neighborhoods of homes that stay affordable for years

As dozens of local officials and advocates recently took a peek at Maura Heft’s new three-bedroom home, she proudly showed off her spacious kitchen with dark wood cabinets and joyfully explained that the home came with a finished basement. Heft and her 6-year-old daughter were moving into their first home that they own. They are the first tenants to move into a new type of affordable housing constructed by Habitat for Humanity of Kansas City on the southern edge of Olathe in Johnson County. It’s a 14-home neighborhood built on a community land trust. That’s a real estate tool that allows the organization to sell the homes at a reduced price — and keep them affordable in the future. Habitat for Humanity sold the home to Heft for about $250,000, less than half of the average home price in the county. Heft said moving into the new home is a life-changing moment for her and her daughter — who have been homeless for five years while staying with family or living in transitional housing — despite Heft working a full-time job.

Read more: KLC Journal

Leawood adopts helmet requirement for minors riding bikes and e-scooters

The Leawood City Council has approved a new ordinance requiring minors to wear helmets on ‘motorized’ devices. The ordinance, passed Monday night, requires anyone under age 18 to wear a secured helmet while operating or riding as a passenger on electric-assisted bikes, scooters, skateboards, mopeds, and similar devices. City officials said the change follows concerns raised by police about the increasing use of e-bikes and e-scooters by juveniles, often without helmets. Violations of the ordinance can result in a warning or a citation carrying a $25 fine. Police have said enforcement will focus first on education and voluntary compliance as residents adjust to the new rule.

Read more: KMBC

Kansas judges test role of courts in helping with recovery

Across Kansas, more judges are becoming attuned to the mental health struggles of those who step into their courtrooms. In Ellis County, 23rd Judicial District Chief Judge Curtis Brown has witnessed the revolving door of people who are battling addiction and untreated mental illness while simultaneously dealing with the court system. “I really like to try to help people out,” Brown says. “You’ve just got to bring in a human element and help these folks.” More than 250 miles to the east, Johnson County District Judge Robert Wonnell has grown more aware of the behavioral health challenges some people face through his work presiding over Division 6 of the 10th Judicial District. Wonnell gained a new perspective in 2019 when he attended a regional conference hosted by the National Judicial Task Force to examine state courts’ responses to mental illness.

Read more: KLC Journal

Wyandotte County commissioner explains potential Chiefs stadium ‘guardrails’

Thursday, Wyandotte County commissioners will decide whether they’ll give back a portion of new sales tax revenue to pay off a domed stadium for the Kansas City Chiefs. The development would go west of 118th Street, between State Avenue and Parallel Parkway, east of 126th Street. All 10 commissioners get to vote on this issue Thursday. Christian Ramirez is the Commissioner for the southeastern portion of the county. The stadium would go in the far western portion. “I don’t, no,” Ramirez said when asked if he knew how he was going to vote Thursday. “I still am reviewing all our comments. We’re taking all comments from yesterday. Right now, I’m just listening.” About 45 people spoke Tuesday night at a public hearing. Only a couple of them supported the way that the potential deal is drawn for Wyandotte County.

Read more: KSN-TV

New sonar tool boosts Sedgwick County’s water‑rescue response

Sedgwick County Fire announced on Saturday via Facebook that it now has a new tool that helps firefighters locate people underwater. The AquaEye Pro is a handheld sonar system designed to help first responders quickly locate drowning victims. According to the company’s website, the tool cuts the average search time by 90%. It can also scan up to 8,000 square meters of water in five minutes, equivalent to 1½ football fields. The device is currently housed at Fire Station 32 in Park City. Sedgwick County Fire says it’s hoping to get another device to keep at a station in Haysville.

Read more: KSN-TV

Rural Kansas hospitals receive over $7 million in federal funding

Sen. Jerry Moran announced on Wednesday that rural Kansas hospitals and community health centers are getting more than $7 million in federal funding. The money comes from fiscal year 2026 appropriations bills, including the one approved by Congress and signed into law by the president this week. “Access to medical care is often a deciding factor for many Kansans when determining whether they will remain in the rural communities they call home,” Moran said in a news release. “These resources will support rural hospitals and community health centers across our state and help to improve outcomes, invest in new medical capabilities, and bolster the critical work of rural providers in caring for Kansans.”

Read more: KSN-TV